Learn how to create a Financial Calculator with HTML and CSS. Includes Future Value, EMI, Savings, Mortgage, and Investment Return calculators.

Table of Contents

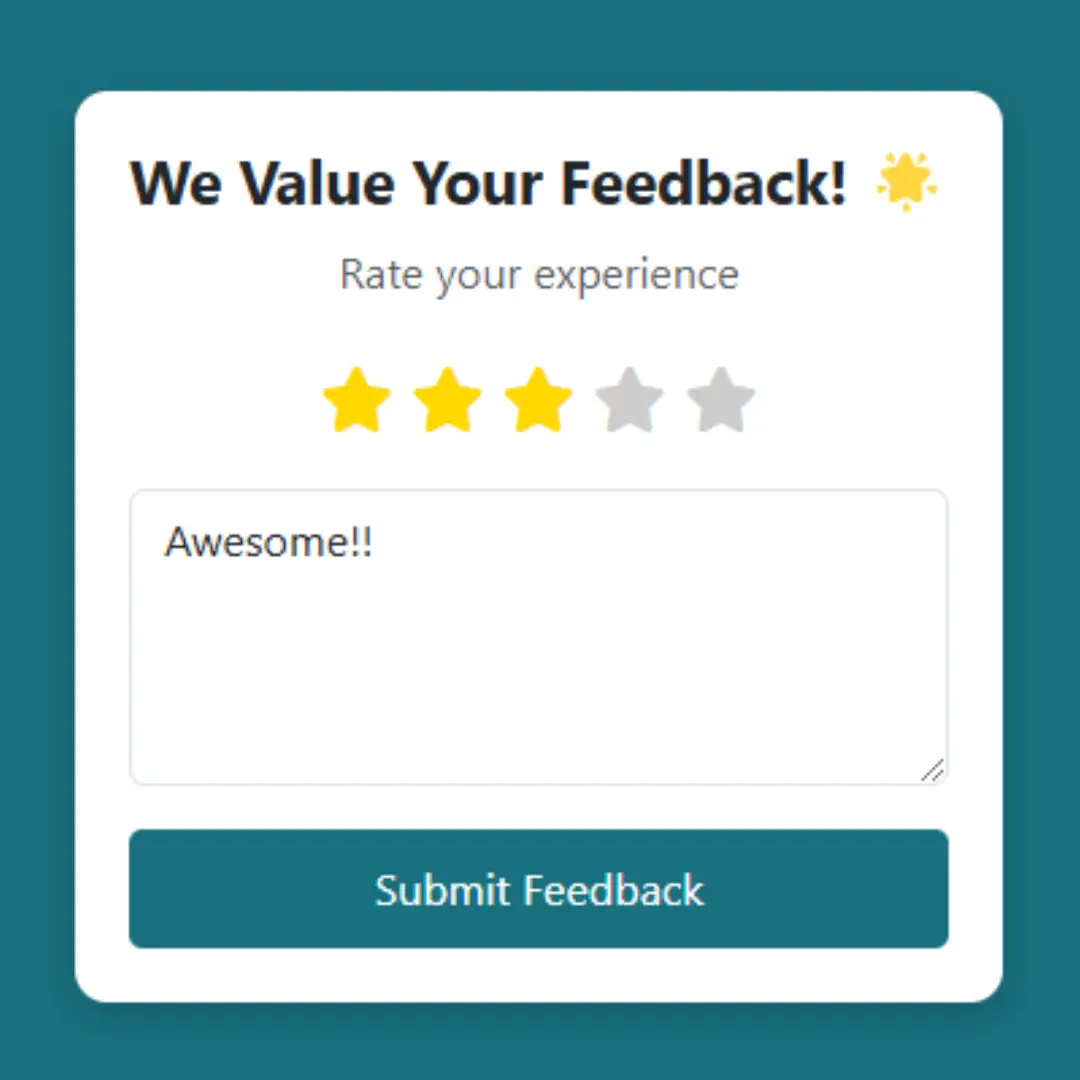

Creating a financial calculator is a great way to enhance your web development skills and provide valuable tools for users. In this guide, we will show you how to build a Financial Calculator using HTML, CSS, and JavaScript. We will cover various types of calculators, including Future Value, EMI/Loan, Savings, Mortgage, and Investment Return calculators. By the end of this tutorial, you'll have a functional and stylish financial calculator for your website.

Our Financial Calculator will feature several useful tools:

- Future Value Calculator: This tool calculates the future value of an investment based on its initial amount, annual interest rate, and investment duration. It helps users estimate how their investments will grow over time.

- EMI/Loan Calculator: Ideal for those looking to take out a loan or mortgage, this calculator computes the monthly EMI (Equated Monthly Installment) based on the loan amount, interest rate, and loan term. It provides a clear picture of the monthly payments required and the total interest payable.

- Savings Calculator: This feature allows users to calculate how their savings will accumulate over time with regular deposits. It factors in the initial deposit, monthly contributions, interest rate, and investment duration to show the future value of the savings.

- Mortgage Calculator: For prospective homeowners, this calculator estimates the monthly mortgage payment including principal, interest, property taxes, homeowners insurance, and other related costs. It also calculates the total amount payable over the life of the mortgage and the total interest amount.

- Investment Return Calculator: This tool helps users estimate the return on their investments based on the principal amount, annual return rate, and investment period. It provides insights into how investments will perform over time, aiding in long-term financial planning.

With a clean and modern design, our calculator will not only look great but will also be highly functional, making it easier for users to perform essential financial calculations and plan their finances effectively. Let’s dive into building this tool step-by-step!

Source Code

Step 1 (HTML Code):

Start by creating an HTML file for your calculator. This HTML code creates a financial calculator with multiple tabs for different types of calculations.

Here's a breakdown of each part:

1. Document Type and Metadata:

<!DOCTYPE html>

<html lang="en">

<head>

<meta charset="UTF-8">

<meta name="viewport" content="width=device-width, initial-scale=1.0">

<title>Financial Calculator</title>

<link rel="stylesheet" href="https://fonts.googleapis.com/css2?family=Poppins:wght@400;500;600;700&display=swap">

<link rel="stylesheet" href="styles.css">

</head>

<!DOCTYPE html>: Defines the document type and HTML version (HTML5).<html lang="en">: Sets the language of the document to English.<meta charset="UTF-8">: Specifies the character encoding as UTF-8.<meta name="viewport" content="width=device-width, initial-scale=1.0">: Ensures the page is responsive and adjusts to different device widths.<title>Financial Calculator</title>: Sets the title of the webpage, displayed on the browser tab.<link rel="stylesheet" href="https://fonts.googleapis.com/css2?family=Poppins:wght@400;500;600;700&display=swap">: Links to a Google Fonts stylesheet for the Poppins font.<link rel="stylesheet" href="styles.css">: Links to an external CSS file for custom styling.

2. Body and Calculator Container:

<body>

<div class="calculator-container">

<h1>Financial Calculator</h1>

<body>: Contains the main content of the webpage.<div class="calculator-container">: A container for the entire calculator content.<h1>Financial Calculator</h1>: A heading for the calculator.

3. Tabs for Different Calculators:

<div class="tabs">

<div class="tab active" data-target="#future-value">Future Value</div>

<div class="tab" data-target="#loan-amortization">Loan</div>

<div class="tab" data-target="#savings-plan">Savings</div>

<div class="tab" data-target="#mortgage-calculator">Mortgage</div>

<div class="tab" data-target="#investment-return">Investment</div>

</div>

<div class="tabs">: Container for the navigation tabs.- Each

<div class="tab">: Represents a tab for switching between different calculators. The data-target attribute links to the respective section.

4. Calculator Sections: Each section corresponds to a tab and contains input fields and a button for calculation.

Future Value Calculator:

<div id="future-value" class="calculator active">

<div class="input-group">

<label for="principal">Principal Amount</label>

<input type="number" id="principal">

</div>

<!-- More input fields and a button -->

<button id="calculate-future-value">Calculate Future Value</button>

<div class="result" id="result-future-value">Future Value: $0</div>

</div>

<div id="future-value" class="calculator active">: Section for the Future Value calculator. The active class makes it visible by default.

Loan Amortization Calculator:

<div id="loan-amortization" class="calculator">

<div class="input-group">

<label for="loan-principal">Loan Amount</label>

<input type="number" id="loan-principal">

</div>

<!-- More input fields and a button -->

<button id="calculate-loan">Calculate Loan Payment</button>

<div class="result" id="result-loan-payment">Monthly EMI: $0<br>Total Amount Payable: $0<br>Interest Amount: $0</div>

</div>

<div id="loan-amortization" class="calculator">: Section for Loan Amortization.

Savings Plan Calculator:

<div id="savings-plan" class="calculator">

<div class="input-group">

<label for="savings-principal">Initial Savings</label>

<input type="number" id="savings-principal">

</div>

<!-- More input fields and a button -->

<button id="calculate-savings">Calculate Savings</button>

<div class="result" id="result-savings">Total Savings: $0<br>Interest Earned: $0</div>

</div>

<div id="savings-plan" class="calculator">: Section for Savings Plan.

Mortgage Calculator:

<div id="mortgage-calculator" class="calculator">

<div class="input-group">

<label for="mortgage-amount">Mortgage Amount</label>

<input type="number" id="mortgage-amount" placeholder="Enter mortgage amount">

</div>

<!-- More input fields and a button -->

<button id="calculate-mortgage">Calculate Mortgage Payment</button>

<div class="result" id="result-mortgage">Monthly Payment: $0<br>Total Mortgage Payable: $0<br>Mortgage Interest: $0</div>

</div>

<div id="mortgage-calculator" class="calculator">: Section for Mortgage Calculator.

Investment Return Calculator:

<div id="investment-return" class="calculator">

<div class="input-group">

<label for="investment-principal">Investment Amount</label>

<input type="number" id="investment-principal">

</div>

<!-- More input fields and a button -->

<button id="calculate-investment">Calculate Investment Return</button>

<div class="result" id="result-investment">Total Return: $0<br>Profit Amount: $0</div>

</div>

<div id="investment-return" class="calculator">: Section for Investment Return.

5. JavaScript Integration:

<script src="script.js"></script> </body> </html>

<script src="script.js"></script>: Links to an external JavaScript file that handles the interactivity and calculations for the calculators.

Step 2 (CSS Code):

Create a styles.css file to make your calculator look modern and attractive. Here’s a breakdown of what each part of the CSS code does:

body Style

font-family: 'Poppins', sans-serif;: Uses the Poppins font for text, with a fallback to any sans-serif font if Poppins isn’t available.background-color: #f4f4f9;: Sets a light grey background color for the page.color: #333;: Sets the text color to a dark grey.margin: 0;: Removes default margin around the page.padding: 20px;: Adds 20 pixels of padding around the page’s content.display: flex;: Uses Flexbox to align children elements.justify-content: center;: Centers child elements horizontally.align-items: center;: Centers child elements vertically.

.calculator-container Style

background-color: #fff;: Sets the background color of the container to white.border-radius: 12px;: Rounds the corners of the container.box-shadow: 0 4px 12px rgba(0, 0, 0, 0.1);: Adds a subtle shadow around the container.max-width: 400px;: Limits the maximum width to 400 pixels.width: 100%;: Sets the width to 100% of its parent container.padding: 30px;: Adds 30 pixels of padding inside the container.

h1 Style

text-align: center;: Centers the text horizontally.color: #333;: Sets the text color to dark grey.font-size: 1.5rem;: Sets the font size to 1.5 times the root element's font size.margin-bottom: 20px;: Adds 20 pixels of space below the heading.

.tabs Style

display: flex;: Arranges child elements in a row.border-bottom: 2px solid #ddd;: Adds a light grey border at the bottom.margin-bottom: 20px;: Adds 20 pixels of space below the tabs.

.tab Style

flex: 1;: Makes each tab take up an equal amount of space.text-align: center;: Centers the text inside each tab.padding: 10px;: Adds 10 pixels of padding inside each tab.cursor: pointer;: Changes the cursor to a pointer when hovering over the tab.transition: background-color 0.3s, color 0.3s;: Smoothly transitions the background color and text color on hover or active state.border-bottom: 2px solid transparent;: Sets a transparent border at the bottom by default.

.tab.active Style

color: #007BFF;: Changes the text color to blue for the active tab.border-bottom: 2px solid #007BFF;: Adds a blue border at the bottom for the active tab.

.tab:hover Style

background-color: #f1f1f1;: Changes the background color to a light grey when hovering over a tab.

.calculator Style

display: none;: Hides the calculator by default.

.calculator.active Style

display: block;: Shows the calculator when it has theactiveclass.

.input-group Style

margin-bottom: 15px;: Adds 15 pixels of space below each input group.

label Style

display: block;: Makes the label a block element, stacking it above the input field.margin-bottom: 5px;: Adds 5 pixels of space below the label.font-size: 0.9rem;: Sets the font size to 0.9 times the root element's font size.color: #555;: Sets the text color to a medium grey.

input Style

width: 100%;: Makes the input field take up the full width of its container.padding: 10px;: Adds 10 pixels of padding inside the input field.font-size: 1rem;: Sets the font size to the same as the root element's font size.border-radius: 8px;: Rounds the corners of the input field.border: 1px solid #ddd;: Adds a light grey border around the input field.outline: none;: Removes the default focus outline.transition: border-color 0.3s;: Smoothly transitions the border color on focus.

input:focus Style

border-color: #007BFF;: Changes the border color to blue when the input field is focused.

button Style

width: 100%;: Makes the button take up the full width of its container.padding: 12px;: Adds 12 pixels of padding inside the button.font-size: 1rem;: Sets the font size to the same as the root element's font size.background-color: #007BFF;: Sets the button's background color to blue.color: #fff;: Sets the text color to white.border: none;: Removes the default border of the button.border-radius: 8px;: Rounds the corners of the button.cursor: pointer;: Changes the cursor to a pointer when hovering over the button.transition: background-color 0.3s, transform 0.2s;: Smoothly transitions the background color and scales the button when pressed.

button:hover Style

background-color: #0056b3;: Changes the background color to a darker blue when hovering over the button.

button:active Style

transform: scale(0.98);: Slightly scales down the button when it is clicked, giving a pressed effect.

.result Style

margin-top: 20px;: Adds 20 pixels of space above the result section.font-size: 1.2rem;: Sets the font size to 1.2 times the root element's font size.color: #333;: Sets the text color to dark grey.text-align: center;: Centers the text horizontally.

body {

font-family: 'Poppins', sans-serif;

background-color: #f4f4f9;

color: #333;

margin: 0;

padding: 20px;

display: flex;

justify-content: center;

align-items: center;

}

.calculator-container {

background-color: #fff;

border-radius: 12px;

box-shadow: 0 4px 12px rgba(0, 0, 0, 0.1);

max-width: 400px;

width: 100%;

padding: 30px;

}

h1 {

text-align: center;

color: #333;

font-size: 1.5rem;

margin-bottom: 20px;

}

.tabs {

display: flex;

border-bottom: 2px solid #ddd;

margin-bottom: 20px;

}

.tab {

flex: 1;

text-align: center;

padding: 10px;

cursor: pointer;

transition: background-color 0.3s, color 0.3s;

border-bottom: 2px solid transparent;

}

.tab.active {

color: #007BFF;

border-bottom: 2px solid #007BFF;

}

.tab:hover {

background-color: #f1f1f1;

}

.calculator {

display: none;

}

.calculator.active {

display: block;

}

.input-group {

margin-bottom: 15px;

}

label {

display: block;

margin-bottom: 5px;

font-size: 0.9rem;

color: #555;

}

input {

width: 100%;

padding: 10px;

font-size: 1rem;

border-radius: 8px;

border: 1px solid #ddd;

outline: none;

transition: border-color 0.3s;

}

input:focus {

border-color: #007BFF;

}

button {

width: 100%;

padding: 12px;

font-size: 1rem;

background-color: #007BFF;

color: #fff;

border: none;

border-radius: 8px;

cursor: pointer;

transition: background-color 0.3s, transform 0.2s;

}

button:hover {

background-color: #0056b3;

}

button:active {

transform: scale(0.98);

}

.result {

margin-top: 20px;

font-size: 1.2rem;

color: #333;

text-align: center;

} Step 3 (JavaScript Code):

Create a scripts.js file to handle the calculations. Here's a breakdown of each section:

1. Tab Switching:

document.querySelectorAll('.tab').forEach(tab => {

tab.addEventListener('click', () => {

document.querySelectorAll('.tab').forEach(t => t.classList.remove('active'));

tab.classList.add('active');

document.querySelectorAll('.calculator').forEach(calc => calc.classList.remove('active'));

document.querySelector(tab.dataset.target).classList.add('active');

});

});

Function: Handles tab switching.

Details:

- Adds an event listener to all elements with the class tab.

- When a tab is clicked, it removes the active class from all tabs and adds it to the clicked tab.

- Hides all calculators and shows the one associated with the clicked tab (based on the data-target attribute).

2. Future Value Calculation:

document.getElementById('calculate-future-value').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('principal').value);

const rate = parseFloat(document.getElementById('rate').value) / 100;

const time = parseFloat(document.getElementById('time').value);

const compounds = parseInt(document.getElementById('compounds').value);

const futureValue = principal * Math.pow((1 + rate / compounds), compounds * time);

document.getElementById('result-future-value').innerText = `Future Value: $${Math.round(futureValue)}`;

});

Function: Calculates the future value of an investment.

Details:

- Takes inputs for principal, interest rate, time, and number of compounds per year.

- Computes the future value using the formula for compound interest.

- Displays the result.

3. Loan Payment Calculation:

document.getElementById('calculate-loan').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('loan-principal').value);

const rate = parseFloat(document.getElementById('loan-rate').value) / 100 / 12;

const time = parseFloat(document.getElementById('loan-time').value) * 12;

const payment = principal * rate * Math.pow(1 + rate, time) / (Math.pow(1 + rate, time) - 1);

const totalPayment = payment * time;

const interestAmount = totalPayment - principal;

document.getElementById('result-loan-payment').innerHTML =

`Monthly EMI: $${Math.round(payment)}<br>Total Amount Payable: $${Math.round(totalPayment)}<br>Interest Amount: $${Math.round(interestAmount)}`;

});

Function: Calculates monthly loan payments.

Details:

- Takes inputs for principal, interest rate, and time in years.

- Computes monthly payments, total payment, and interest amount using the loan formula.

- Displays the results.

4. Savings Calculation:

document.getElementById('calculate-savings').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('savings-principal').value);

const rate = parseFloat(document.getElementById('savings-rate').value) / 100;

const time = parseFloat(document.getElementById('savings-time').value);

const contribution = parseFloat(document.getElementById('savings-contribution').value);

const futureValue = principal * Math.pow((1 + rate), time) + contribution * ((Math.pow((1 + rate), time) - 1) / rate);

const interestEarned = futureValue - principal - (contribution * time);

document.getElementById('result-savings').innerHTML =

`Total Savings: $${Math.round(futureValue)}<br>Interest Earned: $${Math.round(interestEarned)}`;

});

Function: Calculates the future value of savings with regular contributions.

Details:

- Takes inputs for initial principal, interest rate, time, and regular contributions.

- Computes the future value and interest earned.

- Displays the results.

5. Mortgage Calculation:

document.getElementById('calculate-mortgage').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('mortgage-amount').value) || 0;

const downPayment = parseFloat(document.getElementById('down-payment').value) || 0;

const annualRate = parseFloat(document.getElementById('mortgage-rate').value) / 100 || 0;

const years = parseFloat(document.getElementById('mortgage-time').value) || 0;

const propertyTaxes = parseFloat(document.getElementById('property-taxes').value) || 0;

const annualInsurance = parseFloat(document.getElementById('insurance').value) || 0;

const otherTaxes = parseFloat(document.getElementById('other-taxes').value) || 0;

const loanAmount = principal - downPayment;

if (loanAmount <= 0) {

document.getElementById('result-mortgage').innerHTML = 'Down payment cannot be greater than or equal to the mortgage amount.';

return;

}

const monthlyRate = annualRate / 12;

const numberOfPayments = years * 12;

const monthlyPayment = loanAmount * monthlyRate * Math.pow(1 + monthlyRate, numberOfPayments) / (Math.pow(1 + monthlyRate, numberOfPayments) - 1);

const monthlyPropertyTaxes = (propertyTaxes / 12) || 0;

const monthlyInsurance = (annualInsurance / 12) || 0;

const totalMonthlyPayment = monthlyPayment + monthlyPropertyTaxes + monthlyInsurance;

const totalPayment = totalMonthlyPayment * numberOfPayments;

const totalAnnualPropertyTaxes = propertyTaxes * years;

const totalAnnualInsurance = annualInsurance * years;

const totalAnnualOtherTaxes = otherTaxes * years;

const totalCostIncludingTaxes = totalPayment + totalAnnualOtherTaxes;

const interestAmount = totalPayment - loanAmount;

document.getElementById('result-mortgage').innerHTML =

`Monthly Payment: $${Math.round(totalMonthlyPayment)}<br>Total Amount Payable: $${Math.round(totalCostIncludingTaxes)}<br>Interest Amount: $${Math.round(interestAmount)}`;

});

Function: Calculates monthly mortgage payments including taxes and insurance.

Details:

- Takes inputs for loan amount, down payment, interest rate, term, and additional costs like taxes and insurance.

- Computes the monthly payment, total payment, and interest amount.

- Displays the results.

6. Investment Calculation:

document.getElementById('calculate-investment').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('investment-principal').value);

const rate = parseFloat(document.getElementById('investment-rate').value) / 100;

const time = parseFloat(document.getElementById('investment-time').value);

const futureValue = principal * Math.pow((1 + rate), time);

const profitAmount = futureValue - principal;

document.getElementById('result-investment').innerHTML =

`Total Return: $${Math.round(futureValue)}<br>Profit Amount: $${Math.round(profitAmount)}`;

});

Function: Calculates the return on an investment.

Details:

- Takes inputs for principal, interest rate, and time.

- Computes the future value and profit.

- Displays the results.

document.querySelectorAll('.tab').forEach(tab => {

tab.addEventListener('click', () => {

document.querySelectorAll('.tab').forEach(t => t.classList.remove('active'));

tab.classList.add('active');

document.querySelectorAll('.calculator').forEach(calc => calc.classList.remove('active'));

document.querySelector(tab.dataset.target).classList.add('active');

});

});

document.getElementById('calculate-future-value').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('principal').value);

const rate = parseFloat(document.getElementById('rate').value) / 100;

const time = parseFloat(document.getElementById('time').value);

const compounds = parseInt(document.getElementById('compounds').value);

const futureValue = principal * Math.pow((1 + rate / compounds), compounds * time);

document.getElementById('result-future-value').innerText = `Future Value: $${Math.round(futureValue)}`;

});

document.getElementById('calculate-loan').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('loan-principal').value);

const rate = parseFloat(document.getElementById('loan-rate').value) / 100 / 12;

const time = parseFloat(document.getElementById('loan-time').value) * 12;

const payment = principal * rate * Math.pow(1 + rate, time) / (Math.pow(1 + rate, time) - 1);

const totalPayment = payment * time;

const interestAmount = totalPayment - principal;

document.getElementById('result-loan-payment').innerHTML =

`Monthly EMI: $${Math.round(payment)}<br>Total Amount Payable: $${Math.round(totalPayment)}<br>Interest Amount: $${Math.round(interestAmount)}`;

});

document.getElementById('calculate-savings').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('savings-principal').value);

const rate = parseFloat(document.getElementById('savings-rate').value) / 100;

const time = parseFloat(document.getElementById('savings-time').value);

const contribution = parseFloat(document.getElementById('savings-contribution').value);

const futureValue = principal * Math.pow((1 + rate), time) + contribution * ((Math.pow((1 + rate), time) - 1) / rate);

const interestEarned = futureValue - principal - (contribution * time);

document.getElementById('result-savings').innerHTML =

`Total Savings: $${Math.round(futureValue)}<br>Interest Earned: $${Math.round(interestEarned)}`;

});

document.getElementById('calculate-mortgage').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('mortgage-amount').value) || 0;

const downPayment = parseFloat(document.getElementById('down-payment').value) || 0;

const annualRate = parseFloat(document.getElementById('mortgage-rate').value) / 100 || 0;

const years = parseFloat(document.getElementById('mortgage-time').value) || 0;

const propertyTaxes = parseFloat(document.getElementById('property-taxes').value) || 0;

const annualInsurance = parseFloat(document.getElementById('insurance').value) || 0;

const otherTaxes = parseFloat(document.getElementById('other-taxes').value) || 0;

const loanAmount = principal - downPayment;

if (loanAmount <= 0) {

document.getElementById('result-mortgage').innerHTML = 'Down payment cannot be greater than or equal to the mortgage amount.';

return;

}

const monthlyRate = annualRate / 12;

const numberOfPayments = years * 12;

const monthlyPayment = loanAmount * monthlyRate * Math.pow(1 + monthlyRate, numberOfPayments) / (Math.pow(1 + monthlyRate, numberOfPayments) - 1);

const monthlyPropertyTaxes = (propertyTaxes / 12) || 0;

const monthlyInsurance = (annualInsurance / 12) || 0;

const totalMonthlyPayment = monthlyPayment + monthlyPropertyTaxes + monthlyInsurance;

const totalPayment = totalMonthlyPayment * numberOfPayments;

const totalAnnualPropertyTaxes = propertyTaxes * years;

const totalAnnualInsurance = annualInsurance * years;

const totalAnnualOtherTaxes = otherTaxes * years;

const totalCostIncludingTaxes = totalPayment + totalAnnualOtherTaxes;

const interestAmount = totalPayment - loanAmount;

document.getElementById('result-mortgage').innerHTML =

`Monthly Payment: $${Math.round(totalMonthlyPayment)}<br>Total Amount Payable: $${Math.round(totalCostIncludingTaxes)}<br>Interest Amount: $${Math.round(interestAmount)}`;

});

document.getElementById('calculate-investment').addEventListener('click', () => {

const principal = parseFloat(document.getElementById('investment-principal').value);

const rate = parseFloat(document.getElementById('investment-rate').value) / 100;

const time = parseFloat(document.getElementById('investment-time').value);

const futureValue = principal * Math.pow((1 + rate), time);

const profitAmount = futureValue - principal;

document.getElementById('result-investment').innerHTML =

`Total Return: $${Math.round(futureValue)}<br>Profit Amount: $${Math.round(profitAmount)}`;

});Final Output:

Conclusion:

By following this guide, you’ve learned how to create a versatile Financial Calculator using HTML, CSS, and JavaScript. We covered several types of calculators, including Future Value, EMI/Loan, Savings, Mortgage, and Investment Return calculators. Each calculator uses JavaScript to perform the necessary computations and display the results. You can customize these calculators further to meet specific needs or enhance their appearance.

That’s a wrap!

I hope you enjoyed this post. Now, with these examples, you can create your own amazing page.

Did you like it? Let me know in the comments below 🔥 and you can support me by buying me a coffee

And don’t forget to sign up to our email newsletter so you can get useful content like this sent right to your inbox!

Thanks!

Faraz 😊